All About Hsmb Advisory Llc

Table of ContentsThe Hsmb Advisory Llc DiariesThe 30-Second Trick For Hsmb Advisory LlcThe Only Guide to Hsmb Advisory LlcSome Of Hsmb Advisory LlcAll about Hsmb Advisory LlcRumored Buzz on Hsmb Advisory Llc

Ford claims to stay away from "cash money value or long-term" life insurance policy, which is more of a financial investment than an insurance policy. "Those are really complicated, come with high compensations, and 9 out of 10 people don't need them. They're oversold since insurance policy agents make the biggest compensations on these," he says.

Disability insurance can be pricey. And for those that choose for long-term care insurance, this policy might make special needs insurance policy unneeded.

Getting My Hsmb Advisory Llc To Work

If you have a persistent health and wellness issue, this sort of insurance policy can wind up being important (Insurance Advisors). Nevertheless, don't allow it emphasize you or your bank account early in lifeit's generally best to get a policy in your 50s or 60s with the anticipation that you won't be using it until your 70s or later on.

If you're a small-business owner, consider safeguarding your source of income by acquiring service insurance policy. In the occasion of a disaster-related closure or period of rebuilding, business insurance policy can cover your revenue loss. Take into consideration if a substantial climate occasion impacted your shop or manufacturing facilityhow would certainly that affect your revenue?

Plus, utilizing insurance coverage can often cost more than it saves in the long run. If you get a chip in your windscreen, you might consider covering the fixing expense with your emergency situation savings rather of your automobile insurance coverage. Insurance Advise.

The Best Strategy To Use For Hsmb Advisory Llc

Share these ideas to protect liked ones from being both underinsured and overinsuredand speak with a relied on expert when required. (https://www.awwwards.com/hsmbadvisory/)

Insurance coverage that is purchased by a specific for single-person insurance coverage or protection of a family. The specific pays the premium, as opposed to employer-based health insurance where the company typically pays a share of the premium. Individuals may go shopping for and purchase insurance coverage from any strategies readily available in the individual's geographic area.

Individuals and family members may get financial support to decrease the expense of insurance coverage costs and out-of-pocket expenses, yet just when enrolling through Attach for Health Colorado. If you experience certain adjustments in your life,, you are eligible for a 60-day time period where you can enroll in a private strategy, even if it is beyond the annual open enrollment period of Nov.

Little Known Facts About Hsmb Advisory Llc.

- Connect for Wellness Colorado has a full checklist of these Qualifying Life Events. Reliant kids who are under age 26 are qualified to be consisted of as family participants under a moms and dad's coverage.

It might seem straightforward but understanding insurance coverage kinds can also be confusing. Much of this confusion comes from the insurance industry's continuous goal to make personalized protection for policyholders. In developing flexible plans, there are a selection to choose fromand all of those insurance coverage types can make it challenging to comprehend what a certain plan is and does.The 6-Second Trick For Hsmb Advisory Llc

If you die throughout this duration, the individual or people you've named as beneficiaries might get the cash money payment of the plan.

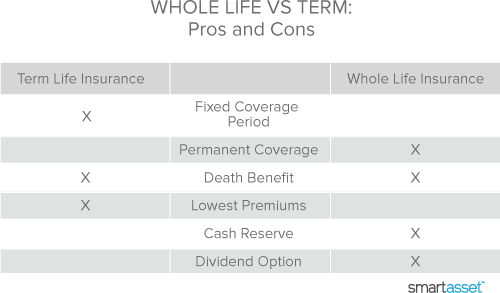

Many term life insurance policies allow you convert them to a whole life insurance coverage policy, so you don't lose coverage. Normally, term life insurance policy premium payments (what you pay monthly or year right into your policy) are not secured in at the time of purchase, so every five or 10 years you possess the plan, your costs could rise.

They likewise often tend to be less expensive total than entire life, unless you buy a whole life insurance policy policy when you're young. There are additionally a couple of variants on term life insurance policy. One, called group term life insurance policy, is common among insurance policy alternatives you may have accessibility to with your employer.The Definitive Guide for Hsmb Advisory Llc

This is normally done at no charge to the employee, with the ability to purchase extra coverage that's gotten of the worker's income. Another variant that you may have access to via your company is supplementary life insurance policy (St Petersburg, FL Life Insurance). Supplemental life insurance policy might consist of unintended death and dismemberment (AD&D) insurance, or interment insuranceadditional coverage that can help your family members in case something unanticipated occurs to you.

Long-term life insurance coverage just refers to any link type of life insurance policy that does not expire.